Veni, Vedi, Vasectomy?

June 5, 2015 at 2:54 pm | Posted in Capitalism, democracy, Human Rights, international relations, Labor, Political Economy, Production, world politics | 1 CommentTags: Europe, European Union, Eurozone, France, Germany, Greece

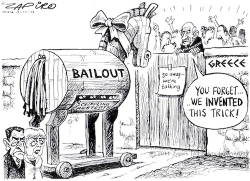

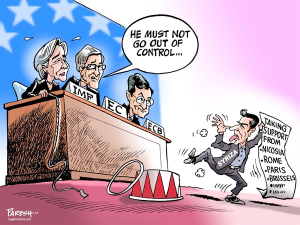

On June 3, when the President of the European Commission (EC), Jean-Claude Juncker conveyed the collective demands of Greece’s creditors—the European Central Bank (ECB), the European Commission, and the International Monetary Fund—to the embattled country’s Prime Minister, Alexis Tsipras, a member of his governing Syriza party said of the Greek delegation: “They came, they saw, and they had their balls handed to them.”

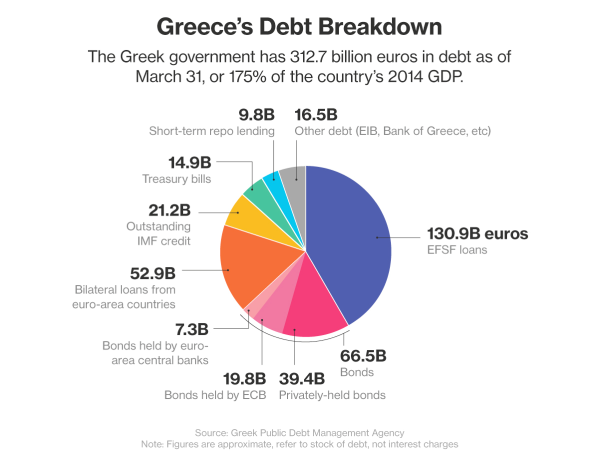

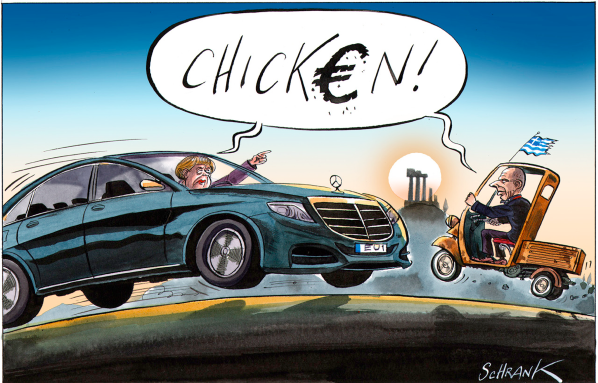

Five months after the anti-austerity party rode to victory in the Greek elections and had renounced efforts by previous Greek governments to impose austerity measures that had led the country’s debt grow from 124 per cent of GDP to 180 per cent and its unemployment rate soar to 25 per cent (and youth unemployment to 60 per cent) and its pensioners see their meagre pensions decline even faster, the German Chancellor Angela Merkel invited the IMF’s Managing Director Christine Lagarde and the President of the ECB, Mario Draghi to a previously scheduled meeting between herself, Juncker, and the French President Francois Hollande on June 1 to draft a common negotiating position among Greece’s creditors. Prime Minister Tsipras was notably not invited.

Papering over their differences, the 5-page demands Juncker delivered to Tsipras made some concessions to Greece—lowering the demand that the primary surplus for 2015 be 1 per cent rather than the 3-4 per cent that had been the earlier demand—but also included “red lines” that the Syriza-led government had vowed never to cross such as generating 2 per cent of the GDP from cutting pensions and raising VAT to a uniform level (except on food, medicines, and hotels), not to reverse the labor market reforms that the ‘troika’ (the ECB, the EC, and the IMF) had forced down the throats of previous governments, and even to establish an ‘independent’ tax and customs agency and thereby making its operations beyond the ambit of elected officials.

Yet, far beyond debates on primary surpluses and ‘red lines,’ the real struggle between Greece and its “European partners” is over politics. The positions are clear. Because of the single currency, an indebted country like Greece cannot devalue its currency and thereby cheapen its exports and with the increase in exports (and tourism) repay its debts. Hence the ‘troika’ (now renamed ‘the institutions’) were attempting to impose an ‘internal devaluation’ on Athens: forcing it to cut minimum wages and increase labor market ‘flexibility’ (making it easier to hire and fire workers and thereby also curb labor militancy) to force down the prices of Greek products to increase exports, to privatize government assets, improve taxation and efficiency in collecting taxes, and to sharply reduce government expenditures by severely cutting welfare programs and reducing public sector employment and pensions. Syriza and other opponents of the ‘austerity’ measures have argued that these measures actually impede Greece’s ability to repay its loans: if people don’t have money due to welfare cuts, job losses, etc., they cannot buy goods and hence more businesses fail. Indeed, Greece’s GDP has contracted by over 25 per cent in the five years of troika-mandated austerity and its unemployment remains high while its debt as a ratio of GDP has grown from 124 per cent to 180 per cent.

As Robert Preston, the BBC’s economics editor puts it:

But although for the pride of the creditors, the question of whether Greece is obliged to generate a surplus on its budget, excluding interest payments, of a bit more than zero or 3%, feels like a world of difference – it is a rounding error compared with the money Greece owes them, which is equivalent to 180% of Greek GDP.

In the highly unlikely event that Greece could generate a 2% or 3% surplus year-in and year-out without its economy shrinking further (which few economists would anticipate), it would take around half a century for Greek public sector debt to fall to a level regarded as sustainable. gett A half century of austerity? In what modern democracy would that be regarded as a realistic option?

Most egregiously, sharp cuts in expenditure has meant that in some hospitals budgets have fallen by 94 per cent. How can this be sustainable in a continent as rich as Europe?

It is clear that one way or another, as Nils Pratley wrote in the Guardian, there will have to be a debt write-down. What Greece’s European “partners” are unwilling to countenance is Syriza’s demands to reverse the “austerity” measures because they want to root out any left-wing challenge to the reigning neo-liberal orthodoxy. Once Greece caves in, subjects itself to ‘vasectomy’ in the words of one of its MPs, then debt-relief could be offered but not before. To offer a write-down of the debt is particularly terrifying to Spain where the governing party has already lost many local elections to a Syriza-like party, Podemos, which now controls the three major cities of Madrid, Barcelona, and Valencia. It is also threatening to other EU economies like Portugal, Ireland, and Italy which have been compelled to implement austerity measures.

Syriza has, however, done its cause no favors despite some eloquent posturing by its Finance Minister, Yanis Varoufakis. It has not demanded a write down of the debt—and we must remember that when the troika made the first loan to Greece in 2010, Germany and France explicitly demanded that the austerity not be extended to the military—and Greece has been the best customer of the German arms industry. How is the cutting of pensions and salaries to workers while maintaining higher than the EU average in military spending morally justifiable?

With Syriza maintaining the charade of negotiating with its European ‘partners’ over the last months, Greece’s position has rapidly deteriorated as frightened depositors have withdrawn their money from the banks and even transferred them outside the country. By the end of April, Greece’s bank deposits were at their lowest level since 2004 and by the end of last week deposits were being withdrawn at the daily rate of 1 billion euros.

Interestingly, the Speaker of the Greek Parliament, Zoe Konstantopoulou, has set up a Debt Truth Committee to report to parliament on June 18

is said to be on the point of finding some of Greece’s original bailout debt, from either 2010 or 2011, was unlawfully contracted. In addition, Ms Konstantopoulou is armed with a finding from experts that Germany owes Greece €350bn in war reparations – more than the whole of its debt to Europe.

This could open up a host of legal challenges even if Tsipiras was to finally cave into the troika’s demands. The question is whether the Left Platform within Syriza is strong enough to prevent a cave in when there is nothing the troika would like than to install a government of national unity with a rump Syriza. That would, temporarily at least till Spain’s November election, decapitate the European Left. Will it happen?

In the short run, if no resolution is found, Greece will be unable to make scheduled payments to its creditors and being declared to be in default would make its borrowing costs in private capital markets intolerable; Syriza’s reluctance to impose capital controls would lead to the swift collapse of its banking sector unless the government begins to issue a virtual currency against future revenues which could ease the liquify crunch domestically at least. But Greece cannot be thrown out of the EU without its consent as all decisions must be unanimous. Even if Greece were to exit the common currency—Grexit as it has been dubbed—it would call the whole European project into question. It is also unrealistic to expect a country as bankrupt as Greece to police its borders when hordes of refugees from Africa and the Middle East are streaming to Europe—and from Greece, they could move to any country in the Schengen area. Will this be enough for its European ‘partners’ to blink?

Poverty of Political Imagination

August 17, 2012 at 11:48 am | Posted in Capitalism, democracy, Free Trade, International Relations, Labor, Political Economy, Production, World Politics | Leave a commentTags: Capitalism, democracy, European Union, financial crisis, Germany, Greece, Political Economy, Spain, United States, world politics

Though it should not have caused any surprise, the news that Eurozone economies had contracted by 0.2 percent in the second quarter of 2012 underscored the deepening economic crisis faced by the 17-state bloc. Though the German economy may have grown by 0.3 percent, France recorded a third straight quarter of no growth, and the Finnish, Italian, Portuguese, and Spanish economies all fell sharply. Greece, of course, suffered the steepest fall: 6.2 percent in the second quarter–and was 18 percent below its GDP level in the April-June quarter of 2008.

There is little doubt that the declines have been aggravated by a failure of political imagination. Confronted by budget deficits brought about by high levels of government borrowing and by the collapses of housing bubbles, the creation of a common currency has meant that indebted Eurozone economies have not been able to resort to a currency devaluation to gain a competitive edge. Consequently, the troika of the European Commission, the European Central Bank, and the International Monetary Fund sought to impose an “internal devaluation” on these economies by forcing budget cuts to lower government deficits and wage cuts.

It follows as the night the day that if budgets and wages are cut, the economy will shrink. Lower government spending due to budget cuts means welfare and pension benefits fall, the cost of health care rises, and educational opportunities vaporize. These impact far more adversely on the elderly and the young. With wage cuts, people have less money to spend and this will depress all sectors of the economy–as sales reduce because of lower spending, companies will slash their work forces leading to greater declines in sales and to further cuts in employment. In the most severely affected of the southern European economies, unemployment rates for the youth are already at 50 percent or more. By May 2012, unemployment in the euro zone had already reached 11.1 percent or 17.5 million people and the International Labor Organization (ILO) estimates that it would rise to almost 22 million in the next four years. And if the euro zone were to break up, the ILO estimates unemployment in the 17-state bloc could reach 17 percent.

The adverse conditions created by the stringent cuts mandated by the troika are aggravated by the greater interest rates imposed on the weaker economies by international financial markets–thus for instance, while Austrian banks and other financial institutions can borrow at 2 percent, Italian banks have to pay 6 percent. As these higher interest costs are passed on by the banks to their borrowers, the cost of doing business in Italy, Spain, Portugal, or Greece increases correspondingly and could even negate the wage cuts imposed by the troika!

The effects of economic contraction will spread to the better performing economies. After all, Germany has been able to have a strong industrial sector because cheaper credit to other eurozone members had allowed them to buy German products while the German small-scale sector–which employs 60 percent of the country’s labor force–did not have to worry about currency movements in other European countries or fear that a strong German mark will price them out of the market in other countries.

As Susan Watkins has written, German lessons on debt repayment are especially galling to the Greeks.

Under the Nazi occupation, a hefty monthly payment was extracted from the Greek central bank to cover the Wehrmacht’s expenses; in March 1942 an additional forced loan of 476 million Reichsmarks was levied by the Axis powers. Greek partisans put up some of the toughest military resistance to the Nazis in Europe; the damage wreaked by the occupiers’ revenge was commensurate. Reprisals were exacted on the civilian population at a rate of fifty Greeks for every German killed. Much of the country’s infrastructure was destroyed; forced exports and economic collapse helped bring about one of the worst famines in modern European history.

German occupation (strictly a tripartite occupation since the Italians and the Bulgarians also participated) of Greece also led to hyperinflation–Richard Clogg says it was

five thousand times more severe than the Weimar inflation of the early 1920s. Price levels in January 1946 were more than five trillion times those of May 1941. The exchange rate for the gold sovereign in the autumn of 1944, shortly after the liberation, stood at 170 trillion drachmas.

After the war, the question of German reparations were deferred till German reunification and in the so-called 2+4 (Bonn and Berlin with the US, the USSR, the UK and France) agreement of 1990, Greek claims were excluded. Though several Greek politicians including the current prime minister, Antonis Samaras when he was the foreign affairs minister in 1991, had raised the issue of 476 million marks with the Germans, their demands were summarily dismissed. If this money had, in fact, been paid as the Germans are legally obliged to do, with interest for more than half a century, Greece would no longer be a problem economy.

It is galling too because while ancient historical myths as Greece being the ‘birthplace of democracy’ are routinely trotted out in discussions of the contemporary situation, recent history that people over 70 remember are carefully hidden from view! Be that as it may.

What is crucial is that the crisis demonstrates that capital and finance markets need to be regulated more stringently. It was irresponsible lending that led to high government deficits in Greece and to the housing bubbles in Spain and Ireland, to the subprime crisis in the US, and to the meltdown of the Icelandic economy to mention just the most obvious cases. Financial markets are continuing to demand punitive rates of interest from the weaker economies. The unchecked power of finance must be corralled–or we will enter another great depression just as the obsession with the gold standard led to the depression as Karl Polanyi showed in his Great Transformation.

What is required is a new political imagination not the shrill advocacy of measures that have already aggravated the situation!

Notes on the Spanish General Strike

March 31, 2012 at 2:19 pm | Posted in Capitalism, democracy, Human Rights, International Relations, Labor, Political Economy, Production, World Politics | Leave a commentTags: 21st Century Capitalism, anti-systemic movements, European Union, Germany, indignados, new forms of protest, Spain, United Kingdom

To be in Barcelona on Thursday March 29, 2012 was to be a witness to a massive tidal wave of humanity on the streets, stretching beyond the horizon in every direction from Placa Catalunya, the city’s symbolic center. This was a response to the general strike called by Spain’s two largest trade unions–Union General de Trabajadores (UGT) affiliated to the Socialist Party, and the Comisiones Obreras (CCOO)–in response to the conservative Partido Popular (PP) government’s decision to announce the most austere budget since the transition to democracy 37 years ago. As evident on the streets of Barcelona, it was much more than a workers’ protest: though some 30 percent of employed workers had said that they would participate in polls before the strike, Spain has a high rate of unemployment–23 percent or double the European rate and almost half the people under 30 are out of work.

The unemployed are the backbone of the indignados (“the outraged”) movement that in May last year that with their tents in city centers and their emphasis on transparency, diversity, egalitarianism, and direct democracy, inspired the Occupy movements across the world. The employment situation is only likely to worsen as Mariano Rajoy, the new PP prime minister who took office in December last year, enacted an Emergency decree two months ago that sharply curbed labor rights. Permanent workers in Spain were eligible for 45 days’ pay for each year of employment if they were fired; this was substantially reduced to a maximum of 33 days and in Andalucia alone eight times as many workers were let go in the two months after the decree was promulgated than in the corresponding period last year. Companies were also permitted to reduce working hours.

The greater flexibility to hire and fire workers provided by the new labor laws may provide greater incomes in the short run to employers but will further depress prospects of economic growth in Spain. Spanish wages are already the lowest among the EU 15 (members of the European Union on 1 May 2004 before the inclusion of states from the former Eastern Europe) and the new law would further depress wages in the context of the high rates of unemployment and provide for more short-term employment–which will lead to a reduction in effective demand.

Moreover, Spain’s economic problems do not stem from high government deficits but from the burst of a property bubble and absurd laws governing liability of borrowers. The Spanish government had run a balanced budget from the time it joined the Euro in 1999 to 2007–that is to say it did not borrow at all during this period unlike many other economies, including Germany, even though interest rates on Eurozone countries fell sharply. However, though Madrid resisted borrowing at lower rates, Spanish citizens could not resist the lure of cheap interest rates and it fueled a housing boom–housing prices rose by 44 percent between 2004 and 2008.

Houses in Spain couldn’t be built fast enough. Great swathes of the coast and the countryside became clustered with urbanisations, instant housing estates thrown up to cater to what seemed to be an endless stream of Britons, Germans, and other norther Europeans now able to live the kind of life abroad of which their parents could only have dreamed.

Once the bubble burst with the financial crisis, however, the economy unraveled rapidly–the number of empty and unsold properties in the country is estimated to be between 700,000 and 1,500,000–and some 40 evictions are taking place across the country per day. Employment in construction collapsed and laid-off construction workers account for fully a third of the unemployed. What is more, Spanish law does not allow homeowners to simply hand over the keys and walk away from a property if they can no longer pay the mortgage. They remain liable for the remainder of the mortgage if the sale of the property does not cover the full extent of the mortgage–and they seldom do in a period when property prices have fallen by more than 19 percent. Hence, unlike most other countries, the unemployed in Spain not only lose their houses but remain responsible for part of their mortgages. This has meant that young people who had moved out of their parental home have often had to move back–and even that grandparents have had to use their pensions to help support their children and grandchildren. In turn, the iaiaflautas or retirees and grandparents have mobilized themselves to occupy buses to protest against price hikes, bank lobbies to oppose bailouts, and health departments to turn back cutbacks.

Hence, even if reports say that the general strike led to a fall in electricity consumption by 16.3 percent compared to a fall of 16.9 percent in the general strike of September 2010, it doesn’t account for the vast mobilization of the indignados, the unemployed, the students, and the iaiaflautas. What it underlines is that a new politics is emerging, a politics that as Ferran Pedret has put it “is characterized by the absence of leaders, by assemblies as a form of organization, and a diversity and transversality.”

it was this that was responsible for the massive turnout–what the strike symbolizes is a new politics, a politics beyond those of political parties because the parties are fully integrated into the system itself that must be changed. So no mere percentages of electricity consumption, businesses that stayed open, or workers participating in the strike can adequately assess its impact.

Japan: Geoeconomic Consequences of Nature’s Fury and Human Folly

March 18, 2011 at 4:02 pm | Posted in Nuclear Non-Proliferation, Outsourcing, Political Economy, Production | Leave a commentTags: 21st Century Capitalism, East Asia, European Union, Global South, Japan, Manufacturing, US Economy, World-economy

Scarcely believable images of the destruction wrought by a 9.0 earthquake that struck 250 miles northeast of Tokyo and unleashed a tsunami that generated 10 meter high waves–of entire communities being obliterated–and made worse by triggering a nuclear meltdown at the Fukushima Daiichi plant has been at the center of world news. While concern has understandably been on the human cost of the tragedy, the economic costs are also staggering. While it is too early to make an assessment, early estimates already suggest that world economic growth may fall by at least a full percentage point.

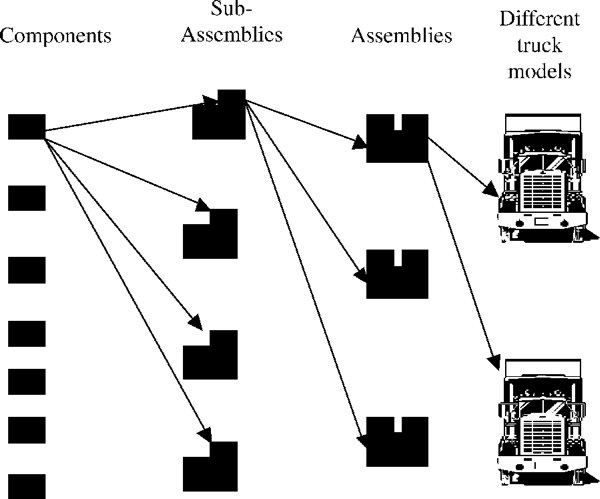

In the most immediate instance, it would cause enormous supply chain disruptions to production as Japanese manufacturers produce a whole array of sophisticated components and finished products. For an economy vitally dependent on exports this could be a vital blow–but it would also affect manufacturers world-wide as they source components from Japan, Additionally, the demand for reconstruction funds for Japan could reasonably be expected to lead to a redirection of financial flows with adverse consequences not only for debt-ridden economies like those of the United States but also for the ’emerging economies’ of the Global South.

The estimated $200 billion required to rebuild Japan after the earthquake on March 11, 2011 and the tsunami already triggered a 6 percent rise in the yen with 5 days–from a peak of ¥76.25 to the dollar to ¥81.20–as investors started repatriating funds for Japanese reconstruction before the G-7 economies intervened in currency markets in a concerted effort to drive the yen lower and help stabilize the Japanese economy as a higher yen would have made Japanese exports dearer overseas and hence driven down demand for them.

Fears that radiation from the crippled nuclear reactors at Fukushima Daiichi may be transported through Japanese exports has led to many restaurants to ban Japanese food items like sushi, Kobe beef, and sake. But there has also been apprehension that consumers may be exposed to radiation when driving a Prius car or using a Japanese DVD–a severe blow to an export dependent economy. Even though such fears may be misplaced because the main manufacturing centers are located away from areas near the crippled nuclear reactors and most manufacturing occurs indoors in factories and hence is not directly exposed to airborne radioactive particles, apprehensions are by nature irrational and could lead to a steep decline in consumer demand.

On March 17, General Motors became the first automobile manufacturer to announce that it will temporarily halt production in its truck plant in Shreveport, Louisiana because of a shortage of Japanese-made parts as a result of the natural disasters in that island nation. The fact that was GM rather than Toyota, Honda, or Nissan to be the first auto manufacturer to stop production because of supply-related problems stemming from the natural disasters underlines the gravity and extent of the disruption of supply-chains from Japan for producers the world over. 10 percent of Volvo’s parts for instance comes from 33 Japanese suppliers, 9 of which were in areas affected by the disasters and Volkswagen has warned of medium-term supply problems. Some Japanese manufacturers–Mitsubishi and Nissan–have opened some of their facilities while Toyota is due to open some of its plants early next week. It is uncertain how long these can operate because they and their suppliers may face problems obtaining raw materials and parts and in shipping finished products due to logistical problems caused by the earthquake, tsunami, and the exclusion zone imposed by fears of a nuclear meltdown at the reactors in Fukushima Daiichi. A Detroit based consultant, John Hoffecker, estimates that an average car had 20,000 components and the abrupt loss of any one component could halt production in its tracks, especially because most manufacturers have implemented just-in-time production systems that reduce inventories.

Given Japan’s advanced manufacturing technologies, disruptions are not limited of course to the automobile sector. Sony Ericsson and Nokia have warned that they face supply problems for their smart phones, for instance. Apple Computer’s latest gadget the iPad 2 depends on the advanced manufacturing technologies of Japan for crucial components like flash memory to store audio and video files that are manufactured by Toyota which shut down its manufacturing facilities due to the earthquake and tsunami. Other iPad 2 components sourced from Japan include “AKM Semiconductor and DRAM memory produced by Elpida Memory. A touchscreen overlay glass is likely from Asahi Glass.” Even if these suppliers are not directly hit by the earthquake, tsunami, or t, the logistical disruptions caused by the natural disasters including obtaining raw materials and parts and shipping finished goods are likely to hamper production.

it is impossible to assess the costs of reconstruction. Initial estimates of $200 billion were based on the experience of the 1995 Kobe earthquake. Not only was the present earthquake much more destructive in scale but it was also accompanied by a massive tsunami and a nuclear meltdown. With a debt-to-GDP ratio double that of the United States, and credit-rating agencies being more prudent after the financial crisis of 2008-09, raising funds at a tolerable rate of interest could be difficult. Unlike the United States which could pump $600 billion as stimulus during the financial crisis, the yen does not enjoy international reserve currency status and hence this is not an option for the Japanese.

This raises the possibility that Japan, which is the third largest holder of US Treasuries, will sell off large chunks of the $877 billion it holds to finance its reconstruction–a sell-off that will have a major impact on interest rates all across the world and depress the value of US Treasuries and could trigger an avalanche of sales of the Treasuries as other holders seek to minimize their holdings. It could cause another enormous liquidity crisis as the financial crisis just did and comes at a time when the economies of the US and the European Union are still weak.

Competition, Trade, Currencies, and Economic Summits

November 14, 2010 at 1:52 pm | Posted in International Relations, Outsourcing, Political Economy, Production, World Politics | Leave a commentTags: 21st Century Capitalism, China, international relations, Manufacturing, United States, US Economy, US hegemony, US politics, world politics, World-economy

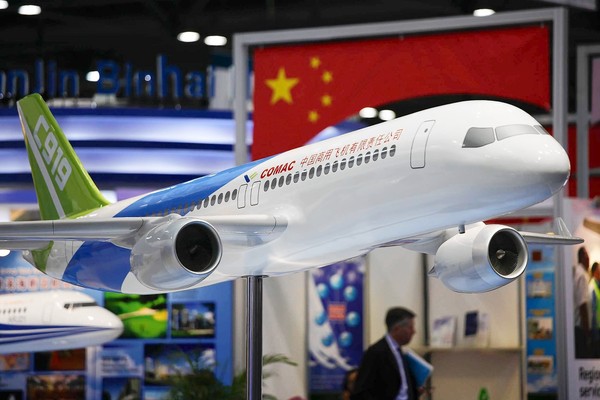

Far more fundamental that the charges and counter-charges of currency manipulation and trade imbalances traded at the November 2010 G-20 summit in Seoul to a shift in the terms of global economic competition was an announcement that the Commercial Aircraft Corporation of China, or Comac, plans the introduction of a 156-seat single-aisle passenger jetliner. The entry of China into the commercial passenger aircraft industry is noteworthy for two reasons.

First, most of the technology for the Chinese C919 plane will be provided by Western companies. The plane’s computer system, brakes, wheels, and power units by Honeywell; its navigation systems by Rockwell Collins; avionics by GE Aviation; fuel and hydraulics by Eaton Corporation; and flight controls by Parker Aerospace. These companies have agreed to a Chinese stipulation that they set up joint ventures with Chinese companies. Though the companies claim that they will safeguard their intellectual property, David Pierson suggests that the example of high-spreed rail proves otherwise. After European and Japanese firms shared their technology with their Chinese joint venture partners, they are now in direct competition with their former Chinese partners both in and out of China.

Yet, projections of China’s rapid rise compels there Western aviation companies to bid aggressively for the Chinese market. In the next twenty years, Chinese air traffic is expected to grow at an annual average rate of 8 per cent a year and to meet this demand the country’s domestic airlines are estimated to purchase some 4,330 planes worth $480 billion over the same period. No supplier of aviation parts wants to miss out on this lucrative market.

If the sheer size of its market confers a competitive advantage on China in technology transfer, it is also the case that 55% of Chinas exports are accounted by foreign-owned companies. Moreover, China’s large current account surpluses with the United States and the European Union is matched by large deficits with other countries as shown by a recent article in the Financial Times. In many cases, transnational production and procurement networks span across national borders to take advantage of wage and cost differentials and a substantial part of China’s exports are only assembled and packaged there from components made elsewhere. This means that these foreign-owned companies are not particularly receptive to calls for China to revalue its currency–or indeed, the attempt by the US Federal Reserve to force down the value of the greenback by releasing $600 billion to buy US Treasury bonds: what a former Chairman of the Fed, Alan Greenspan termed “a policy of currency weakening.”

Devaluing the dollar by releasing more greenbacks is “clueless” as the German Finance Minister Wolfgang Schäuble called it because it would raise the cost of living in the United States when the unemployment rate is hovering at double digits and is unlikely to create a spurt in job growth in the United States. In fact, though President Obama trumpeted that his visit to India would create 54,000 jobs in the US, that is merely a third of the jobs created in the country in just the last month as Alan Beattie noted in the Financial Times.

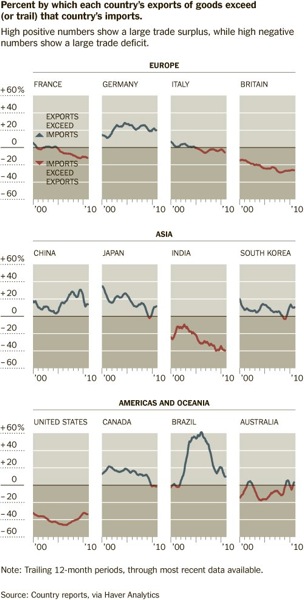

In part, trade imbalances have taken center-stage because during the financial meltdown in 2008 and 2009, trade contracted sharply and thereby reduced trade imbalances as Floyd Norris noted in the New York Times. A modest recovery however highlighted the imbalances and governments began to accuse each other of undervaluing currencies.

Such charges and counter-charges ignore the changes in competitive pressures. With the greater deployment of automated technologies and numerically-controlled machines, and the Taylorization of even skilled work, wage charts increasing resemble a time-glass: fewer and fewer extraordinarily well-paying jobs, and more and more sub-subsistence jobs as indicated in several prior posts. These underlying conditions can be addressed only in the long-run through well developed plans that do not respect two-year electoral cycles which is the focus not only of Washington politicians but also of the US punditocracy!

The one remaining competitive advantage the United States has is that its currency is the only reserve currency but if the Fed devalues the dollar–and already uncertainties in currency markets has led to the price of gold soaring to $1,400 a troy ounce–as Robert Zoellich, the President of the World Bank, has suggested it is likely to lead to multiple reserve currencies. And that will seal the end of the United States as an economic superpower.

A Third Wave of Outsourcing?

November 6, 2010 at 6:32 pm | Posted in Labor, Outsourcing, Political Economy, Production | 3 CommentsTags: 21st Century Capitalism, China, India, labor process, Manufacturing, trade wars, US Economy, US hegemony, World-economy

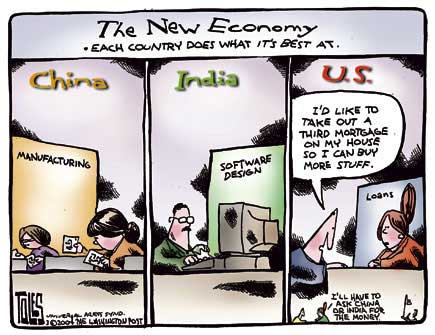

Persistently high unemployment figures in the United States have led to strident calls by politicians about ‘unfair’ trading practices by China, India, and other countries and demands to curb outsourcing of US jobs to lower wage locations overseas. Much of the discussion, especially in the context of President Barack Obama’s 10-day visit to Asia, has focussed on low-cost manufacturing in China and white-collar service work to India, a new type of outsourcing pioneered by Amazon.com’s Mechanical Turk service just five years ago, represents the potential to transform outsourcing in some sectors. This represents a further assault on incomes.

Claiming to take the tedium out of repetitive, monotonous tasks that are notoriously difficult to automate (recognition of handwritten messages or numbers, for instance), a handful of companies are creating software to further deskill digital labor. Essentially, these companies–Microtask, CloudCrowd, Cloudflower, and others–break up tasks into many different component parts both to shield the identity of their clients (as each worker gets to see only a miniscule portion of the document and therefore cannot identify the real client) and to lower labor costs by widely distributing the tasks: Cloudflower claims to have a virtual workforce of 500,000 people in 70 countries while CloudCrowd which was formed only in 2009 claims a virtual workforce of 25,000 and says it has completed 2 million tasks by September 2010 according to its promotional video.

Companies take different approaches. Microtask, a Finnish upstart, contracts with firms and provides software to its clients’ employees which enables them to do a small task–recognition of handwritten numbers, comparison of two images of a product, few minutes of speech transcription–without leaving their computer screen to get more information from the Internet. The software rotates and mixes up the tasks so that there is no monotony while the main computers of the client can compile the tasks performed by its employees–leading to an unprecedented level of control while minimizing the possibility of leaks.

Other companies directly contract with individual workers. At the Mechanical Turk website, there are are number of tasks on offer and once a person performs a test to show his or her talent at a job–identifying business locations, proof-reading, and such like–they can sign up and do tasks steadily at their own pace and when they want to work. However, Randall Stross reports in the New York Times that when Miriam Cherry, a law professor at the University of the Pacific and her research assistant tried an assignment offering 2 cents “each for finding the contact information of 7,500 hotels and 3 cents each for answering questions about 9,400 toys,” they did not even make the minimum wage!

As Stross notes, “Worker control is precisely what the Microtask model has engineered out–that’s the source of its insidious efficiency. Just as Ford’s assembly lines a century ago brought work to workers who performed a single, repetitive task, Microtask’s software, via the Internet, does the same. Every two seconds.”

Yet, the so-called ‘cloudsourcing’ (from the Internet ‘cloud’) model is different in crucial respects. By farming out work across the planet, companies do not have to confront organized labor–protests against low wages become infinitely more difficult if workers are spread across many, many jurisdictions. Cloudcrowd, for instance, takes translations of business documents that used to be done by a single person and initially submits it to translation software. The software translation is then broken up into pages and sent to people who look for nonsensical sentences. These are then submitted to native speakers and finally to editors who have no special expertise in the language, but simply make the text more readable. By farming out the work to several unconnected individuals, anonymity is assured and translation costs are minimized–from 20-25 cents a word to just 6.7 cents. And, of course, minimum wage legislation would not apply.

![640_fiat_hot_autumn__69[1].jpg 640_fiat_hot_autumn__69[1].jpg](https://rpalat.files.wordpress.com/2010/11/640_fiat_hot_autumn__6911.jpg?w=300&h=217)

Even if these widely-distributed tasks do not earn minimum wages in the United States and other high-income economies, they beat the minimum wage in many low-income countries and hence many of the workers for Cloudflower and other ‘cloudsourcing’ companies are located in places like Malaysia and the Philippines. Seen in this light, too, it is not surprising that the new president of the State University of New York at Albany, George M. Philip, could eliminate the departments of Italian, French, Russian, Classics, and Theatre without hesitation!

Create a free website or blog at WordPress.com.

Entries and comments feeds.