Detroitism in Binghamton: A Photo Essay

July 27, 2013 at 9:56 am | Posted in Capitalism, democracy, Human Rights, Outsourcing, Political Economy, world politics | 3 CommentsTags: Capitalism, democracy, Human Rights, Manufacturing, United States, Urban, world politics, World-economy

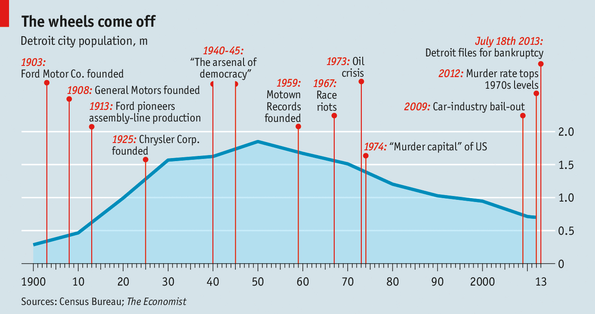

Detroitism has emerged a while ago to encapsulate the emergence of urban ruins in North America and Europe–from Camden NJ to Naples and Bucharest–with the decline of manufacturing and the outsourcing of production to low- and middle-income economies in Asia and Latin America. Populations of these cities have declined sharply–from 1.8 million fifty years ago to 700,000 today in Detroit, shrinking tax revenues and depressing property values leading to a degradation of city services and civic amenities and spiking the crime rate. Abandoned houses are stripped of their valuables–metal and copper are sold to junk merchants to be sent to India and China to be melted down and recycled to fuel these ’emerging economies.’

Smaller towns and cities in the United States have been declining even longer–for more than a century as the mechanization of agriculture and the exhaustion of natural resources set in even before manufacturing began to move to the non-unionized states of the ‘Sunbelt’ and later to even lower-wage locations overseas. And the emergence of ‘big box’ retailers like Wal-mart hollowed out their commercial cores as Edward Alden noted.

And so it has been with Binghamton, located at the confluence of the Susquehanna and the Chenango rivers in southern New York State. A small farming community till the Chenango Canal was constructed in the mid-1830s, linking it the the Erie Canal at Utica. In addition, the arrival of the railways in the mid-19th century transformed the area into a minor industrial hub for the production of cigars, and later shoes, and high-tech electronics. Between 1860 and 1880, the population of Binghamton rose from 8,325 to a little over 35,000. Tanneries and shoe factories–most notably the Endicott Johnson shoe factory–made Binghamton and its neighboring Johnson City one of the major shoe manufacturing centers in the United States

B y the mid-1950s however, competition from several other locations led to a steep decline of shoe production though its impact was cushioned by the rise of several high-tech firms: IBM which was founded in nearby Endicott, Edwin Link who invented the flight stimulator, Valvoline which was to become Whirlpool Corporation

y the mid-1950s however, competition from several other locations led to a steep decline of shoe production though its impact was cushioned by the rise of several high-tech firms: IBM which was founded in nearby Endicott, Edwin Link who invented the flight stimulator, Valvoline which was to become Whirlpool Corporation

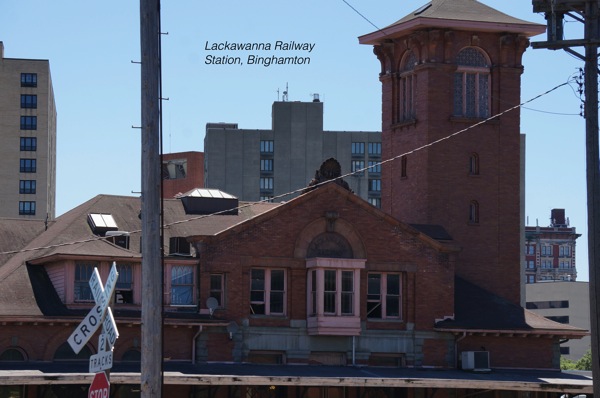

At the same time, the construction of the interstate highway system, led to a fall in ridership on the trains and the last passenger train rolled off the tracks of the Lackawanna Station in Binghamton in December 1964.

The continuing growth of IBM and other technology companies related to defense and the location of one of the four university centers of the State University of New York system led to further growth over the next two decades.

Yet, the gradual decline of IBM and the closure of the last shoe factory in the 1990s led to a precipitous decline in the fortunes of the city. The arrival of big box retailers like Wal-Mart finally hollowed out the city’s commercial core.

The population of Binghamton, which had peaked at 80.674 in 1950 slid to 47, 376 in the census of 2010–less than it was a 100 years ago in 1910.

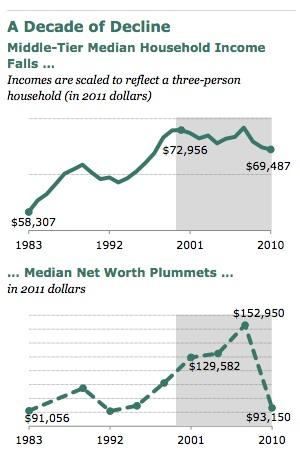

The Vanishing Middle Class

October 5, 2012 at 3:46 pm | Posted in Uncategorized | Leave a commentTags: 21st Century Capitalism, Manufacturing, Political Economy, Production, US Economy, US politics, World-economy

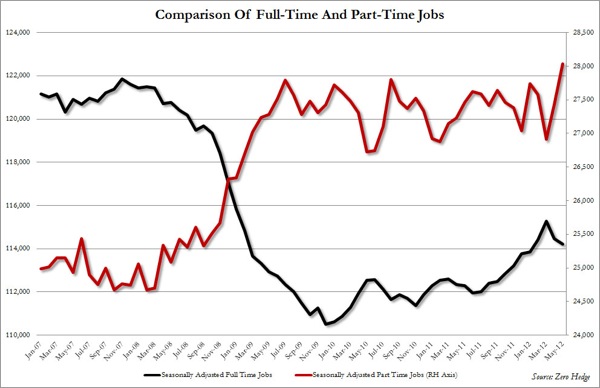

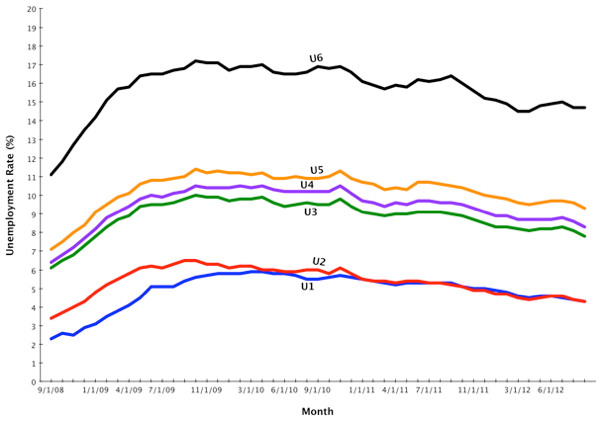

News today that the US unemployment rate dropped in September 2012 to 7.8 percent from 8.1 percent in August and is now at the lowest level since President Barack Obama took office will undoubtedly boost his campaign for re-election, two days after his dismal performance in the first debate with his Republican opponent, Mitt Romney. If this is good news for the president, the situation is less rosy than it appears. According to the Bureau of Labor Statistics, the number of workers stuck in part-time jobs in September stood at 8.5 million, an increase of 581 million from the previous month and double the level it was in September 2007. Even worse, the number of full-time workers in the US has declined by 5.9 million since September 2007 while the number of part-time workers has increased by 2.6 million.

In fact, if the number of part-timers looking for full-time work, the U6 unemployment rate, is considered, it is unchanged

And as Moira Herbst writes in the Guardian,

It’s distressing to think that after 20th-century labor struggles won the battle for the 40-hour work week, the 21st-century struggle is a fight for enough working hours to make a living wage.

In another report in today’s New York Times, the average number of employees per new firm declined from 7.7 persons in 1999 to 4.7 in 2011. For almost the last half-century, new companies have accounted for the bulk of jobs created in the United States, In fact, without new start up companies, the United States would have seen a growth in jobs for only 7 years since 1977! The numbers of new jobs created by new companies was the greatest in 1999 as a result of the dot com boom and by 2011, it had declined by some 46 percent.

One major result of the decline of full-time employment and the rise of part-time employment is that part-timers are denied virtually all benefits. Without healthcare and other benefits, workers are increasingly compelled to rely on Medicaid and emergency room visits for illnesses and as Herbst noted, this leads to a shift in costs from employers to tax payers. This is of course covered up by both political parties in the United States: the Democrats tout the new decline in unemployment figures but never mention that 6.9 million people were working multiple jobs in the US in September. The Republicans stress cutting taxes–making health care even less accessible to the poor.

Both focus on a middle-class that is rapidly shrinking and not on the increasing numbers of people below the middle class. For them, neither candidate has anything to offer–and therein lies the shame! In today’s politics, the concerns of the masses are silent–the decline of manufacturing not only hollowed out industries but by also kneecapping labor, it has made both major political parties alike–both shifting further and further to the right, and both having nothing to offer to the vast majority of the population.

Japan: Geoeconomic Consequences of Nature’s Fury and Human Folly

March 18, 2011 at 4:02 pm | Posted in Nuclear Non-Proliferation, Outsourcing, Political Economy, Production | Leave a commentTags: 21st Century Capitalism, East Asia, European Union, Global South, Japan, Manufacturing, US Economy, World-economy

Scarcely believable images of the destruction wrought by a 9.0 earthquake that struck 250 miles northeast of Tokyo and unleashed a tsunami that generated 10 meter high waves–of entire communities being obliterated–and made worse by triggering a nuclear meltdown at the Fukushima Daiichi plant has been at the center of world news. While concern has understandably been on the human cost of the tragedy, the economic costs are also staggering. While it is too early to make an assessment, early estimates already suggest that world economic growth may fall by at least a full percentage point.

In the most immediate instance, it would cause enormous supply chain disruptions to production as Japanese manufacturers produce a whole array of sophisticated components and finished products. For an economy vitally dependent on exports this could be a vital blow–but it would also affect manufacturers world-wide as they source components from Japan, Additionally, the demand for reconstruction funds for Japan could reasonably be expected to lead to a redirection of financial flows with adverse consequences not only for debt-ridden economies like those of the United States but also for the ’emerging economies’ of the Global South.

The estimated $200 billion required to rebuild Japan after the earthquake on March 11, 2011 and the tsunami already triggered a 6 percent rise in the yen with 5 days–from a peak of ¥76.25 to the dollar to ¥81.20–as investors started repatriating funds for Japanese reconstruction before the G-7 economies intervened in currency markets in a concerted effort to drive the yen lower and help stabilize the Japanese economy as a higher yen would have made Japanese exports dearer overseas and hence driven down demand for them.

Fears that radiation from the crippled nuclear reactors at Fukushima Daiichi may be transported through Japanese exports has led to many restaurants to ban Japanese food items like sushi, Kobe beef, and sake. But there has also been apprehension that consumers may be exposed to radiation when driving a Prius car or using a Japanese DVD–a severe blow to an export dependent economy. Even though such fears may be misplaced because the main manufacturing centers are located away from areas near the crippled nuclear reactors and most manufacturing occurs indoors in factories and hence is not directly exposed to airborne radioactive particles, apprehensions are by nature irrational and could lead to a steep decline in consumer demand.

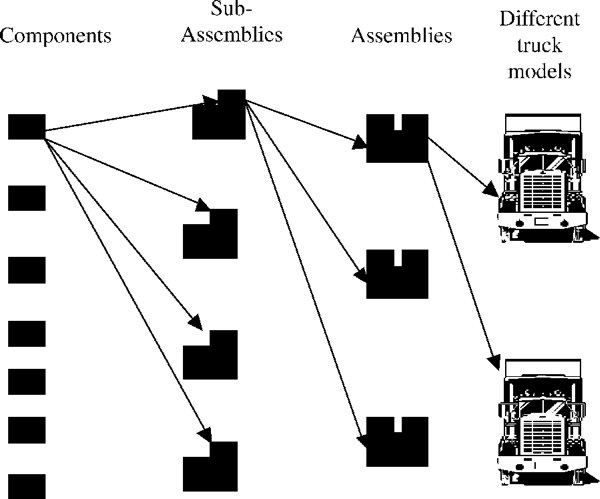

On March 17, General Motors became the first automobile manufacturer to announce that it will temporarily halt production in its truck plant in Shreveport, Louisiana because of a shortage of Japanese-made parts as a result of the natural disasters in that island nation. The fact that was GM rather than Toyota, Honda, or Nissan to be the first auto manufacturer to stop production because of supply-related problems stemming from the natural disasters underlines the gravity and extent of the disruption of supply-chains from Japan for producers the world over. 10 percent of Volvo’s parts for instance comes from 33 Japanese suppliers, 9 of which were in areas affected by the disasters and Volkswagen has warned of medium-term supply problems. Some Japanese manufacturers–Mitsubishi and Nissan–have opened some of their facilities while Toyota is due to open some of its plants early next week. It is uncertain how long these can operate because they and their suppliers may face problems obtaining raw materials and parts and in shipping finished products due to logistical problems caused by the earthquake, tsunami, and the exclusion zone imposed by fears of a nuclear meltdown at the reactors in Fukushima Daiichi. A Detroit based consultant, John Hoffecker, estimates that an average car had 20,000 components and the abrupt loss of any one component could halt production in its tracks, especially because most manufacturers have implemented just-in-time production systems that reduce inventories.

Given Japan’s advanced manufacturing technologies, disruptions are not limited of course to the automobile sector. Sony Ericsson and Nokia have warned that they face supply problems for their smart phones, for instance. Apple Computer’s latest gadget the iPad 2 depends on the advanced manufacturing technologies of Japan for crucial components like flash memory to store audio and video files that are manufactured by Toyota which shut down its manufacturing facilities due to the earthquake and tsunami. Other iPad 2 components sourced from Japan include “AKM Semiconductor and DRAM memory produced by Elpida Memory. A touchscreen overlay glass is likely from Asahi Glass.” Even if these suppliers are not directly hit by the earthquake, tsunami, or t, the logistical disruptions caused by the natural disasters including obtaining raw materials and parts and shipping finished goods are likely to hamper production.

it is impossible to assess the costs of reconstruction. Initial estimates of $200 billion were based on the experience of the 1995 Kobe earthquake. Not only was the present earthquake much more destructive in scale but it was also accompanied by a massive tsunami and a nuclear meltdown. With a debt-to-GDP ratio double that of the United States, and credit-rating agencies being more prudent after the financial crisis of 2008-09, raising funds at a tolerable rate of interest could be difficult. Unlike the United States which could pump $600 billion as stimulus during the financial crisis, the yen does not enjoy international reserve currency status and hence this is not an option for the Japanese.

This raises the possibility that Japan, which is the third largest holder of US Treasuries, will sell off large chunks of the $877 billion it holds to finance its reconstruction–a sell-off that will have a major impact on interest rates all across the world and depress the value of US Treasuries and could trigger an avalanche of sales of the Treasuries as other holders seek to minimize their holdings. It could cause another enormous liquidity crisis as the financial crisis just did and comes at a time when the economies of the US and the European Union are still weak.

Competition, Trade, Currencies, and Economic Summits

November 14, 2010 at 1:52 pm | Posted in International Relations, Outsourcing, Political Economy, Production, World Politics | Leave a commentTags: 21st Century Capitalism, China, international relations, Manufacturing, United States, US Economy, US hegemony, US politics, world politics, World-economy

Far more fundamental that the charges and counter-charges of currency manipulation and trade imbalances traded at the November 2010 G-20 summit in Seoul to a shift in the terms of global economic competition was an announcement that the Commercial Aircraft Corporation of China, or Comac, plans the introduction of a 156-seat single-aisle passenger jetliner. The entry of China into the commercial passenger aircraft industry is noteworthy for two reasons.

First, most of the technology for the Chinese C919 plane will be provided by Western companies. The plane’s computer system, brakes, wheels, and power units by Honeywell; its navigation systems by Rockwell Collins; avionics by GE Aviation; fuel and hydraulics by Eaton Corporation; and flight controls by Parker Aerospace. These companies have agreed to a Chinese stipulation that they set up joint ventures with Chinese companies. Though the companies claim that they will safeguard their intellectual property, David Pierson suggests that the example of high-spreed rail proves otherwise. After European and Japanese firms shared their technology with their Chinese joint venture partners, they are now in direct competition with their former Chinese partners both in and out of China.

Yet, projections of China’s rapid rise compels there Western aviation companies to bid aggressively for the Chinese market. In the next twenty years, Chinese air traffic is expected to grow at an annual average rate of 8 per cent a year and to meet this demand the country’s domestic airlines are estimated to purchase some 4,330 planes worth $480 billion over the same period. No supplier of aviation parts wants to miss out on this lucrative market.

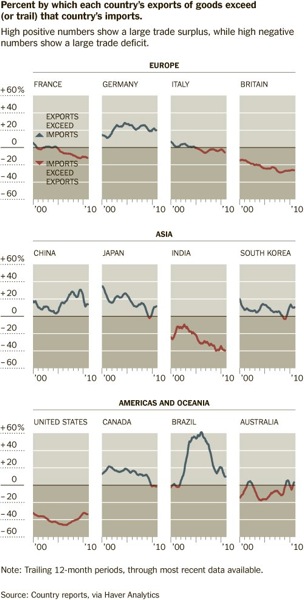

If the sheer size of its market confers a competitive advantage on China in technology transfer, it is also the case that 55% of Chinas exports are accounted by foreign-owned companies. Moreover, China’s large current account surpluses with the United States and the European Union is matched by large deficits with other countries as shown by a recent article in the Financial Times. In many cases, transnational production and procurement networks span across national borders to take advantage of wage and cost differentials and a substantial part of China’s exports are only assembled and packaged there from components made elsewhere. This means that these foreign-owned companies are not particularly receptive to calls for China to revalue its currency–or indeed, the attempt by the US Federal Reserve to force down the value of the greenback by releasing $600 billion to buy US Treasury bonds: what a former Chairman of the Fed, Alan Greenspan termed “a policy of currency weakening.”

Devaluing the dollar by releasing more greenbacks is “clueless” as the German Finance Minister Wolfgang Schäuble called it because it would raise the cost of living in the United States when the unemployment rate is hovering at double digits and is unlikely to create a spurt in job growth in the United States. In fact, though President Obama trumpeted that his visit to India would create 54,000 jobs in the US, that is merely a third of the jobs created in the country in just the last month as Alan Beattie noted in the Financial Times.

In part, trade imbalances have taken center-stage because during the financial meltdown in 2008 and 2009, trade contracted sharply and thereby reduced trade imbalances as Floyd Norris noted in the New York Times. A modest recovery however highlighted the imbalances and governments began to accuse each other of undervaluing currencies.

Such charges and counter-charges ignore the changes in competitive pressures. With the greater deployment of automated technologies and numerically-controlled machines, and the Taylorization of even skilled work, wage charts increasing resemble a time-glass: fewer and fewer extraordinarily well-paying jobs, and more and more sub-subsistence jobs as indicated in several prior posts. These underlying conditions can be addressed only in the long-run through well developed plans that do not respect two-year electoral cycles which is the focus not only of Washington politicians but also of the US punditocracy!

The one remaining competitive advantage the United States has is that its currency is the only reserve currency but if the Fed devalues the dollar–and already uncertainties in currency markets has led to the price of gold soaring to $1,400 a troy ounce–as Robert Zoellich, the President of the World Bank, has suggested it is likely to lead to multiple reserve currencies. And that will seal the end of the United States as an economic superpower.

A Third Wave of Outsourcing?

November 6, 2010 at 6:32 pm | Posted in Labor, Outsourcing, Political Economy, Production | 3 CommentsTags: 21st Century Capitalism, China, India, labor process, Manufacturing, trade wars, US Economy, US hegemony, World-economy

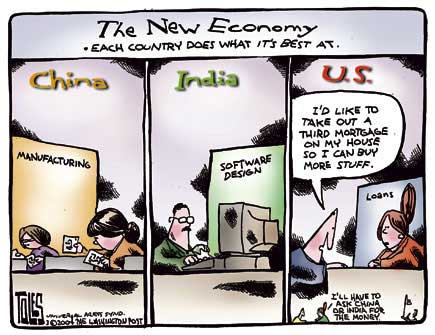

Persistently high unemployment figures in the United States have led to strident calls by politicians about ‘unfair’ trading practices by China, India, and other countries and demands to curb outsourcing of US jobs to lower wage locations overseas. Much of the discussion, especially in the context of President Barack Obama’s 10-day visit to Asia, has focussed on low-cost manufacturing in China and white-collar service work to India, a new type of outsourcing pioneered by Amazon.com’s Mechanical Turk service just five years ago, represents the potential to transform outsourcing in some sectors. This represents a further assault on incomes.

Claiming to take the tedium out of repetitive, monotonous tasks that are notoriously difficult to automate (recognition of handwritten messages or numbers, for instance), a handful of companies are creating software to further deskill digital labor. Essentially, these companies–Microtask, CloudCrowd, Cloudflower, and others–break up tasks into many different component parts both to shield the identity of their clients (as each worker gets to see only a miniscule portion of the document and therefore cannot identify the real client) and to lower labor costs by widely distributing the tasks: Cloudflower claims to have a virtual workforce of 500,000 people in 70 countries while CloudCrowd which was formed only in 2009 claims a virtual workforce of 25,000 and says it has completed 2 million tasks by September 2010 according to its promotional video.

Companies take different approaches. Microtask, a Finnish upstart, contracts with firms and provides software to its clients’ employees which enables them to do a small task–recognition of handwritten numbers, comparison of two images of a product, few minutes of speech transcription–without leaving their computer screen to get more information from the Internet. The software rotates and mixes up the tasks so that there is no monotony while the main computers of the client can compile the tasks performed by its employees–leading to an unprecedented level of control while minimizing the possibility of leaks.

Other companies directly contract with individual workers. At the Mechanical Turk website, there are are number of tasks on offer and once a person performs a test to show his or her talent at a job–identifying business locations, proof-reading, and such like–they can sign up and do tasks steadily at their own pace and when they want to work. However, Randall Stross reports in the New York Times that when Miriam Cherry, a law professor at the University of the Pacific and her research assistant tried an assignment offering 2 cents “each for finding the contact information of 7,500 hotels and 3 cents each for answering questions about 9,400 toys,” they did not even make the minimum wage!

As Stross notes, “Worker control is precisely what the Microtask model has engineered out–that’s the source of its insidious efficiency. Just as Ford’s assembly lines a century ago brought work to workers who performed a single, repetitive task, Microtask’s software, via the Internet, does the same. Every two seconds.”

Yet, the so-called ‘cloudsourcing’ (from the Internet ‘cloud’) model is different in crucial respects. By farming out work across the planet, companies do not have to confront organized labor–protests against low wages become infinitely more difficult if workers are spread across many, many jurisdictions. Cloudcrowd, for instance, takes translations of business documents that used to be done by a single person and initially submits it to translation software. The software translation is then broken up into pages and sent to people who look for nonsensical sentences. These are then submitted to native speakers and finally to editors who have no special expertise in the language, but simply make the text more readable. By farming out the work to several unconnected individuals, anonymity is assured and translation costs are minimized–from 20-25 cents a word to just 6.7 cents. And, of course, minimum wage legislation would not apply.

![640_fiat_hot_autumn__69[1].jpg 640_fiat_hot_autumn__69[1].jpg](https://rpalat.files.wordpress.com/2010/11/640_fiat_hot_autumn__6911.jpg?w=300&h=217)

Even if these widely-distributed tasks do not earn minimum wages in the United States and other high-income economies, they beat the minimum wage in many low-income countries and hence many of the workers for Cloudflower and other ‘cloudsourcing’ companies are located in places like Malaysia and the Philippines. Seen in this light, too, it is not surprising that the new president of the State University of New York at Albany, George M. Philip, could eliminate the departments of Italian, French, Russian, Classics, and Theatre without hesitation!

Absurdities of the US Electorate

October 25, 2010 at 9:26 pm | Posted in Political Economy | Leave a commentTags: Manufacturing, trade wars, US Economy, US politics

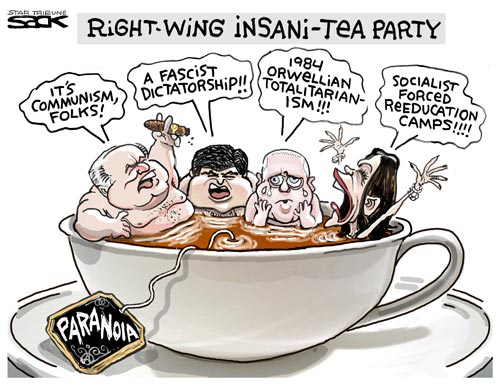

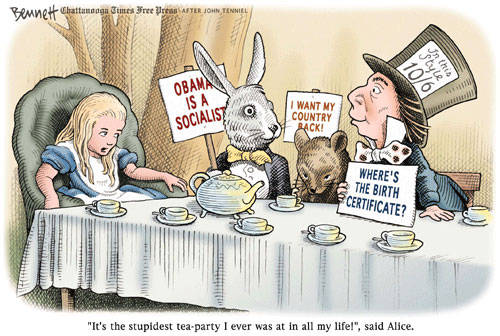

Whom the gods would destroy, they first make mad…using this apt Latin metaphor, in a recent post, Ed Darrell notes the absurdity of the current US mid-term election campaign. An electorate that was passive in 2000 when the US Supreme Court stole a presidential election and the ‘winner’ in that election went on to wage war against a country that could not have threatened the US or defended itself is now screaming ‘socialism’ when the government seeks to provide a minimum level of health care to the young and the elderly while careful to preserve the high profits of insurance companies. An electorate seemingly unconcerned with the enormous cost of the illegal wars waged in Afghanistan and Iraq, and the evidence of billions of dollars being distributed in plastic bags, is enraged at a modest stimulus to the US economy. An electorate that does not register the torture of Iraqis by US forces or the ‘rendition’ of alleged ‘terrorists’ for torture by other states sees plans to build a mosque in downtown Manhattan as proof of the Islamicization of the United States. It is an electorate that continues to believe, in spite of all evidence to the contrary, that its first non-Caucasian president is a Muslim.

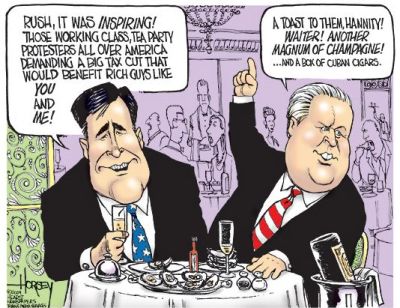

The paradox is heightened by the ‘grassroots’ opposition to the elites when it is the elites funding the ‘grassroots’ Tea Party Movement. George Monbiot has documented how the two Koch brothers–owners of the second largest privately held company in the US and each worth over $21 billion–have financed a bevy of special interest groups to fund and sustain the Tea Party Movement so that they can retain more of their profits, avoid regulation, and pay less taxes. And once the John Roberts Supreme Court ruled restrictions on campaign financing unconstitutional, it has opened the floodgates to corporate financing of elections. Never before in US elections have large corporations and wealthy individuals contributed so much to an election campaign as reported by the New York Times and the Financial Times.

Elite sponsorship of essentially white working class protests is all the more striking as the unemployed workers blame the government for the loss of jobs and the high rate of unemployment, when it is the corporate members of the US Chambers of Commerce–funding the Tea Party candidates–that are responsible for outsourcing US jobs overseas! “American Free Enterprise” is creating more jobs overseas than it is at home!

In part, this disconnection between perceptions and reality among the electorate is because of the absence of critical voices in the mainstream media. There are hardly any representatives of labor or of working families on news shows in the last two decades. Instead we are fed with a constant stream of well-paid talking heads, representing no opinion but their own. There is, hence no questioning of the functioning of the economic system. John Boehner, the Republican leader poised to become the Speaker of the US House of Representatives, has pointedly refused to specify how he would cut the deficit–and in fact, he cannot.

It was, after all, under Republican presidents–Reagan, Geoge H W Bush, George W Bush–that the Federal deficit ballooned beyond control. In the absence of critical commentary, the Republican Party and their Tea Party affiliates have been focusing on side issues–on whether President Barack Obama is American-born or whether he is a Muslim–to evade debate on crucial issues. And they have been able to do this because he is not a Caucasian!

Such racist, and frankly incoherent, rhetoric has gained ascendancy primarily because serious debate has been eliminated from mainstream media–especially television. Instead of sustained debate on serious issues, we are fed a steady diet of inconsequential issues–debate on the mosque in Manhattan, the pastor of essentially a family congregation in Florida threatening to burn the Koran, the racist rants of Juan Williams and Bill O’Reilly–rather than issues of substance.

Peering Beyond the US Midterm Elections

October 19, 2010 at 11:17 pm | Posted in Political Economy | Leave a commentTags: 21st Century Capitalism, Afghanistan, Iran, Iraq, Manufacturing, US Economy

What is likely to happen if the Republicans win control of one or both houses of Congress? The issues underlying the discontent of voters stem from the loss of employment and increasing inequality; of losing homes sold on dreams while they see the bankers walk away with millions of dollars in bonuses; fear of a further erosion of jobs overseas or to immigrants; belief that if only government spending is lower, taxes will fall and conditions will be better for the poor.

Regardless of the propaganda that it is unfair currency manipulation by other countries that is leading to a loss of jobs, the underlying cause is very different and no politician or party has a solution to the problem. Well paying jobs are disappearing because of technological changes. The evidence is everywhere–growth of emails and the Internet leads to a decline of post office jobs; the internet is as much of a threat to shopping malls and big box stores as these were to main streets; automated check-in machines at airports decimates counter staff; Netflix has spelt the doom of bricks and mortar video stores. No political party or economist has the remotest idea of what to do in these conditions, least of all the know-nothing Republicans affiliated to the Tea Party!

If other countries were to raise the value of their currencies, it means that they will no longer buy as many dollars as they had to keep their currencies “undervalued.” It was the repatriation of current account surpluses and domestic savings from China and other countries through their purchase of US dollars that enabled them to manipulate exchange rates. This massive inflow of capital enabled the Bush–and now Obama–Administration to fight two wars in Iraq and Afghanistan while cutting taxes. Without such capital inflows, taxes would have to rise or the US military will have to turn tail and slink back.

Perhaps, this is may explain why the US has swallowed a bitter pill and invited high Iranian representatives to in-depth briefings on Afghanistan by the military commander, General David Petreus and even begun to transport Taliban leaders to Kabul for talks in NATO aircraft. Iran’s footprint has also solidified in Iraq where the Shi’ite cleric Muqtada al-Sadr, allied to Iran, has emerged as king-maker. Any move against Iran will unravel US plans to withdraw from Iraq and Afghanistan.

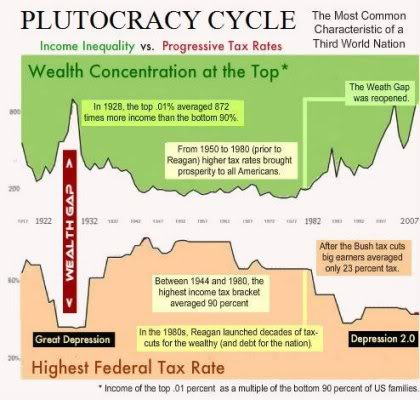

Despite all this, if the Congress cuts taxes, it would mean cutting into the bone of welfare state, removing any semblance of a safety net under the poor. It will exacerbate the income gap between the rich and poor, already wider than at any time since the 1920s since a Republican victory in the elections will ensure that the rich cats will continue to walk away with bonuses in the seven and eight figures. Why else will they contribute so disproportionately to Republican candidates in the current election?

All of this does not even begin to address the military situation. What will the neocons make of the Taliban being invited back into power in Afghanistan and Iran exercising considerable influence in Iraq. And the Iraqi oil? Estimates of Iraq’s proven oil reserves has increased by almost 20 billion barrels but all of this is being exploited by Russian, Chinese, and other Asian companies–not US Big Oil!

Outsourcing and Currency Wars

October 10, 2010 at 4:59 pm | Posted in Political Economy | Leave a commentTags: 21st Century Capitalism, Asia, China, Manufacturing, trade wars, US Economy

The US Department of Commerce reports that in the last two years, the number of employees of foreign affiliates and subsidiaries of US firms grew by 729,000 while these firms cut some 500,000 jobs domestically over the same period.

http://www.latimes.com/business/la-fi-jobs-offshoring-20101006,0,1485516.story

Candidates of both major parties lay the blame for this on the Chinese government intervening in currency markets to keep the value of the renminbi artificially low and thereby gain an unfair advantage against US workers as companies ship manufacturing operations off-shore to take advantage of wage differentials.

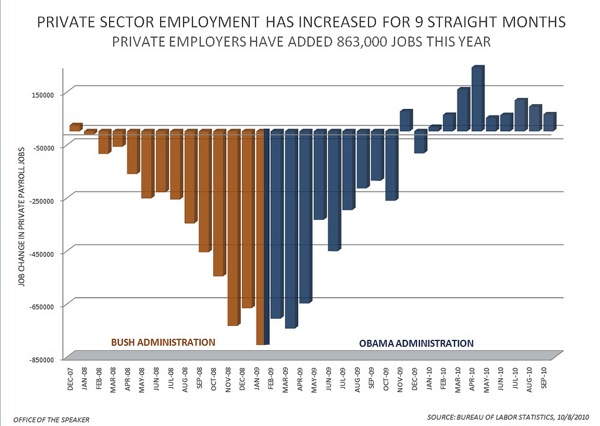

But the emphasis in this argument is misplaced. In the first instance, manufacturing jobs have been disappearing from the United States for several decades. The Bureau of Labor Statistics reports that in September 2010 alone, more private sector jobs were created in the United States than in the entire 8 years of the George W. Bush Administration.

More significantly, a look at China’s trade statistics reveals that its huge current account surpluses with the US and the European Union is counterbalanced by substantial deficits with its East and Southeast Asian neighbors. Indeed, components and intermediate goods dominate intra-Asian trade and China has emerged as a assembly point for parts manufactured elsewhere. This implies that any appreciation of Chinese currency could mean that China could import more intermediate goods and thereby offset any gains that might accrue to US producers from the higher value of Chinese wages. There is also no guarantee that manufacturers wont shift jobs to other low wage countries like Laos, Cambodia, or Vietnam if Chinese wages increase

Jobs, Jobs, Jobs

October 8, 2010 at 9:18 pm | Posted in Political Economy | Leave a commentTags: 21st Century Capitalism, China, Manufacturing, US Economy

Just released reports show that the unemployment rate in the United States has been above 9 percent for over 37 months, the longest period since the 1930s

http://www.washingtonpost.com/wp-dyn/content/article/2010/10/08/AR2010100802491.html?hpid=topnews

Compounding matters, the number of people working part-time because they cannot find full-time work increased by 612,000 in September 2010 and stood at 9.5 million.

Not surprisingly, hourly wages has remained stagnant at $22.67 and provided no stability to family budgets.

http://www.nytimes.com/2010/10/09/business/economy/09jobs.html?hp

Much of the unemployment problems in the United States has been blamed on the outsourcing of jobs to China where it is alleged the government keeps wages low by artificially holding down the value of its currency, the renminbi. This has animated support for the “Currency Reform for Fair Trade Act” passed last week by the US Congress.

Yet, what this overlooks is that China too has been losing employees in its formal sector for several years now. Since the Chinese economy is dependent on export–and has recently surpassed Germany to be the leading export economy in the world–it has to constantly upgrade its manufacturing facilities which implies using machines, computers, and numerically controlled tools in place of labor. In absolute numbers, the International Labor Organization estimates that the formal industrial sector in China laid off some 35.1 million workers between 1990 and 2002.

Underlying this collapse of formal sector employment in the manufacturing sector. not only in China and the United States, but world-wide is a downgrading of industrial activities in the global divisioning of labor.

Historically, as companies start to follow in the footsteps of pioneer enterprises, profit margins begin to shrink and competitive pressures lead to an accumulation of larger volumes of capital than could be invested in the production of sale of commodities without driving profit margins down even further. This leads to a phase of speculation and ‘financial capitalism,’ that Fernand Braudel and Giovanni Arrighi identified as a “sign of autum” of one world-wide system of accumulation and the transition to another.

It is this historical cycle rather than currency manipulation by the Chinese government or the short-sightedness of previous and current US administrations that lies at the root of the current crisis.

Blog at WordPress.com.

Entries and comments feeds.