Capitalism as Anti-Market

December 16, 2010 at 10:39 pm | Posted in Capitalism, Free Trade, Political Economy, World Politics | 2 CommentsTags: 21st Century Capitalism, US Economy, US hegemony, US politics, World-economy

Nothing shatters the myth of free market capitalism than reports that an anonymous group of bankers from the largest Wall Street giants meet privately on the third Wednesday of every month to overseas trading in derivatives. Though the big banks claim that this secretive committee–“even their identities have been strictly confidential” says a New York Times report–exists to safeguard the integrity of the markets, they also have fought bitterly to prevent other banks from entering the market and obstructed all attempts to make full information on prices and fees freely available.

In the most profitable sector of the economy–where derivatives traders are routinely paid tens and hundreds of millions of dollars as compensation and bonuses–markets do not function the way the politicians, economists, commentators, and bureaucrats tell us they do: the forces of supply and demand do not operate without distortions; there is no free flow of information or transparency and customers are price-takers rather than price-makers.

This, of course, has always been true of capitalism. Fernand Braudel had argued that contrary to prevailing myths, capitalism is anti-market. The market economy, the world of transparent visible realities on which ‘economic science’ was founded, he contended was ‘the not unacceptable face of ‘micro-capitalism,’ barely distinguishable fro ordinary work,” it was very different from the rarefied heights from where exceptional profits–as cornered by the derivatives traders and financiers–are reaped.

It is precisely because derivatives are ‘exotic’ instruments and not understood by the public, that the virtual identity between free markets and capitalism incessantly proclaimed by policymakers, economists, and journalists live on in the public domain. In many transactions at the corner grocery store or a farmers’ market, there is an appearance of free markets–of small producers and shop keepers selling goods to the public, “barely distinguishable from ordinary work.” But even here, the principles of the market do not operate. No seller in a farmer’s market can know the costs of production of their competitors and nor could consumers go to every seller even in a nearby area to compare prices–in most cases, sellers quote prices they think they can get away with and consumers pay what they think they can afford.

Derivatives trade, of course, is very different. They are designed to shift risks. Typically, if the price of a gallon of oil is $2.50, large consumers may choose to lock in future supplies at $2,80 a gallon so that if prices soar to $3.00 or $3.50 a gallon, they will be insulated from the rise. Their suppliers have no idea how much lower they could charge their customers because the banks dont disclose the process by which prices are set. This is where the collusion takes place–and where the big profits are reaped.

If this is not enough, we also learn that as the financial crisis set in 2008, the US Federal Reserve opened its vaults a staggering 174 times within a 13-month period to the Citigroup, that Barclays, the British Bank owed the Fed some $48 billion at one time and on and on the list goes of the US Central Bank massively shoring up domestic and foreign banks and even to corporations such as Harley Davidson and McDonalds without public scrutiny. Needless to say, no such facility was ever considered for smaller operators. So much for free markets without the distorting influence of the state!

Wikileaks, Iran, and the Middle East

December 10, 2010 at 3:24 pm | Posted in Arms Control, Human Rights, International Relations, Nuclear Non-Proliferation, World Politics | Leave a commentTags: international relations, interstate system, Iran, Israel, Middle East, Palestine, Saudi Arabia, US hegemony, world politics

Wikileaks–the largest unauthorized dump of diplomatic cables in history–has cast light into the shady world of diplomacy and in the Middle East revealed the deep animosity the rulers of Saudi Arabia have for the Iranian government. This is of course not news as the al-Ahram weekly noted but it did confirm to the Arab street how complicit their rulers are with the United States. It is not surprising that Saudi Arabia and other Persian Gulf states that had supported Saddam Hussein;s war against Iraq urged the US to strike against the Islamic Republic: “cut off the head of the snake,” the Saudi king Abdullah reportedly urged the Americans. And, King Hamad bin Isa al-Khalifa of Bahrain said that the United States should take out Iran’s nuclear capabilities “by whatever necessary.”

If the Obama Administration cite these and other remarks to justify a broad-based Arab opposition to Iran’s nuclear program, as Sharif Abdul Kouddous notes, none of these are democratic regimes and are propped up by American military, diplomatic, and financial support. The opposition to Iran expressed by these regimes was not reflected in the Arab Street. A Brookings Institute poll indicates a vast majority of the Arab population believe that the United States and israel are a greater threat to regional peace and political stability than Iran and they clearly recognize the double standards applied to Israel and Iran. Israel has over 200 nuclear warheads and faces no sanctions while Iran has not a single warhead, has said that it is not pursuing a nuclear weapons program, is facing increasingly stringent sanctions. The Wikileaks expose autocratic Arab rulers to be what they are: stooges dependent on the United States for their survival.

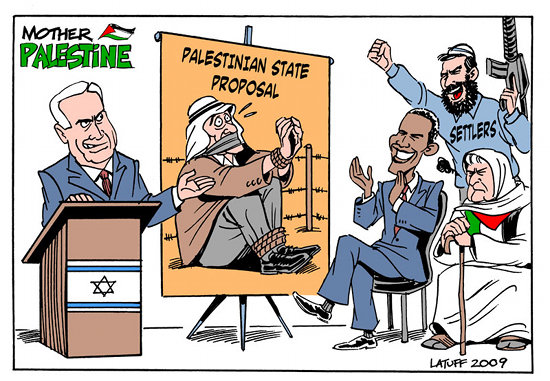

Moreover, as the media was focused on the information divulged by Wikileaks and the arrest of Julian Assange, the Obama Administration gave up trying to persuade the Israeli government to freeze settlement activity for 90 days so that the ‘peace talks’ with the Palestinian Authority could be resumed. They had concluded that even with a bribe of $3 billion dollars, the Israeli government was unwilling to cease constructing settlements in the Occupied Territories for a mere three months. As Andrew Bacevich notes, though the Israeli military power is unparalleled in the region, the continued offer of advanced US weaponry–as the offer of 20 F-35 aircraft for a nonrenewable 90-day freeze on settlement activity–continues to give credence to Israeli politicians’ claim that the security of the Jewish state is in jeopardy.

Bizarrely, as Palestinians dispatched firefighters to fight the Mount Carmel fire–the largest fire in Israel’s history–in early December 2010, Israeli soldiers were deployed near the Palestinian villages of Bil’in, Nil’in and Nabi Saleh, where Israelis, Palestinians, and international activists organize weekly non-violent protests against Israel’s 480-mile separation wall and its policy of settlements in the Occupied Territories. And the Israeli Ambassador to the United States, Michael B. Oren while acknowledging the contributions of the Palestinian fire-fighters chose to castigate the Palestinian leadership for not returning to the talks without mentioning the reasons for their refusal–the continued and unlawful expropriation of their land!

Indeed, Palestinian Authority President Mahmoud Abbas is in such an untenable situation with the Obama Administration urging him to continue to talk to the Israelis while the latter continue to gobble up Palestine and work to render any potential Palestinian state unviable, that he has threatened to extinguish “Palestinian self-rule” in the West Bank. This would imply that the Israelis will have to resume responsibility for the 2.2 million Palestinians as the military occupying power, a responsibility they had relinquished after the Oslo Accords and the creation of the Palestinian Authority in 1994. If this would cause chaos in the short-run as the Palestinian Authority employs some 150,000 people, it will put an end to a farcical situation and will undercut any legitimacy to these meaningless “peace process.” It would end too, all prospects of a two-state solution which of course was no solution at all.

Eurozone’s Woes

December 4, 2010 at 5:47 pm | Posted in International Relations, Political Economy, world politics | Leave a commentTags: 21st Century Capitalism, Euro, Greece, Iceland, Ireland, Italy, Kazakstan, Portugal, Spain, world politics, World-economy

The Euro–the single currency adopted by 16 states–has been under siege for over a year beginning with the election of a new government in Greece in September 2009 which sharply revised the country’s public deficit from 6 percent of GDP to 12.7 percent. This led to a loss of confidence in the government’s ability to repay loans and raised the cost of borrowing, creating greater difficulties for the government to repay the 300 billion euro debt bequeathed to it by its predecessor in office. Normally, a government faced with high debts could devalue its currency and thereby increase the competitiveness of its exports and attract both foreign investments and tourists but the adoption of the common currency ruled out this option.

Eventually, the European Central Bank (ECB) and the International Monetary Fund (IMF) cobbled together a rescue package of €110 billion ($146 billion) in May 2010 in return for Greece implementing very severe austerity measures. European policy makers also set up a European Financial Stability Facility (EFSF) to create a safety net of upto €750 billion to preserve financial stability among member states of the common currency.

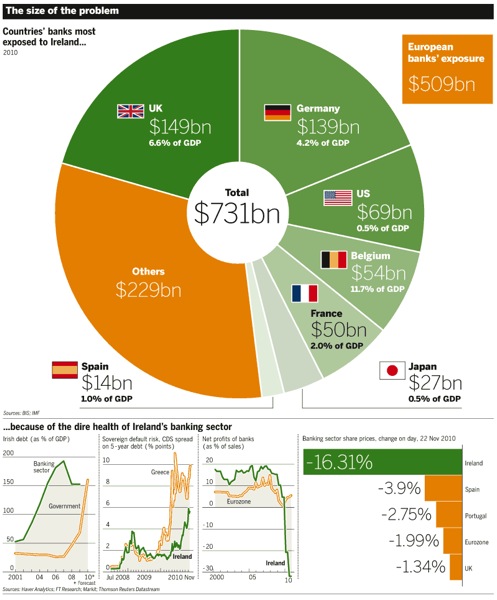

These floodgates came under renewed threat when German Chancellor Angela Merkel made a statement that in future financial crises, creditors must also share in the losses rather than only the tax-payers. As Ireland was the most indebted economy within the Eurozone, this caused interest rates on Irish bonds to spike causing a further crisis in confidence. Unlike the Greek crisis which was caused by high public deficits, the Irish crisis was caused by a collapse of its housing bubble.

Soon after the introduction of the single currency, weak economic demand in the main Eurozone economies–Germany’s real domestic demand in 2008 was only 5 percent higher than in 1999–fueled an asset price inflation-especially in Ireland and Spain. As the former taoiseach (Prime Minister) Garret Fitzgerald noted, the house construction rate in the Celtic Tiger in the last two decades was six times that of Britain–leading to an extraordinary housing bubble stimulated by the Anglo Irish bank and a host of overseas banks. When the bubble burst, instead of the banks’ creditors sharing the losses, the government assumed their payment obligations, nationalizing the Anglo-irish Bank and creating the National Asset Management Agency to take over large loans from other banks, effectively transforming private debt into public debt.

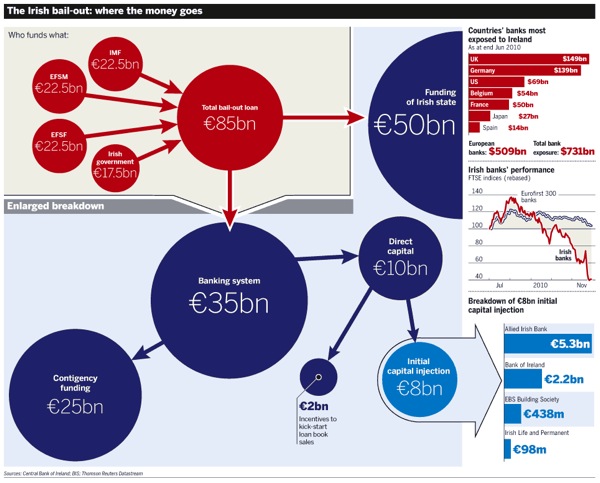

The ECB and IMF have once again cobbled together a rescue package of €85 billion ($115 billion) but this has not stopped a massive gap in the bond spreads (an increase in the cost of borrowing for the weaker members of the Eurozone, especially Greece, Ireland, Portugal, Spain, and Italy) and the fear is that if the crisis spreads to Spain and Italy, two of the largest economies, the EFSF would be inadequate and it would cause an enormous political conundrum: citizens of the stronger states will become increasingly unwilling to bail out the more ‘profligate’ states, and citizens of the latter would be unwilling to put up with increasingly stringent long-term austerity measures.

Spain is fortunate because a large amount of its government debt is owed to its own banks rather than to overseas banks. At the beginning of 2010, Spain’s public debt was only 53 percent of GDP, about 20 percentage points below that of the Eurozone average and half that of Italy’s. Last year, when the budget deficit stood at 11.1 percent of GDP, Prime Minister Jose Luis Rodriguez Zapatero also pushed through an austerity package that led to the government’s deficit falling by 47 percent in the first ten months of 2010. The problem for Spain is its high private debt–especially the heavy borrowing from overseas banks to fund home construction in the years up to 2008, Before the start of the recession, Gilles Moec of the Deutsche Bank estimated that private sector debt was 210 percent of GDP compared to 130 percent for Germany, France, and Italy.

If the extent of the impending crisis have left many to wonder about the future of the euro, the problem surely is not in the common currency. As Philippe Legrain wrote in the Financial Times there is a lot to be said for

What was the problem was that capital from the stronger members of the Eurozone was channeled to fund asset bubbles in Ireland, Spain, and elsewhere. Tighter regulations of cross-border investments can mitigate this problem. But more importantly, why are lenders coddled in cotton wool while taxpayers are burdened with huge debts they had done nothing to incur? Ordinary Irish citizens, as Paul Krugman, has underlined are:

bearing a burden much larger than the debt — because those spending cuts have caused a severe recession so that in addition to taking on the banks’ debts, the Irish are suffering from plunging incomes and high unemployment.

Earlier when Iceland and Kazakhstan faced financial crises, creditors shared in the pain. The external debt of Kazakhstan’s banking sector which had stood at 26 percent of GDP when the crisis struck in February 2009 had been cut almost in half by September 2010 by making creditors share in the losses and accepting various combinations of senior and subordinated debt. There is no reason to let banks off the hook. In Iceland, the crisis caused the election of a left-leaning government which also were able to get better terms.

If the current crisis enveloping the Eurozone leads to the election of more left leaning governments, and to a refusal to nationalize private debt and to greater regulations over the economy, it may be the final nail in the neoliberal coffin!

Blog at WordPress.com.

Entries and comments feeds.